Read in : தமிழ்

The battle over milk has come to a boil across the south, with states fiercely guarding against a liquid invasion that threatens not only revenue but also regional pride.

At stake is the survival of state-owned milk and dairy federations such as Aavin of Tamil Nadu, Nandini in Karnataka and Milma in Kerala as they face an all-India push by Gujarat-based dairy giant Amul. While Amul does have an overseas and pan-India presence in the dairy products sector, state units have a price advantage in the milk market due to subsidies. However, backed by Union Minister for Cooperatives Amit Shah, Amul is pushing into these territories as a milk vendor. Amul, helmed by the Gujarat Co-operative Milk Marketing Federation Ltd which controls the brand, currently procures about 1.2 crore litres of milk from various states including Gujarat, UP, MP and Karnataka. During the last financial year (FY 2022-2023) it earned about Rs. 55,000 crore in revenue.

As part of the new strategy, Amul has begun to set up a network in Tamil Nadu to procure and sell milk within the state. It has negotiated with several Self Help Groups located in the border districts of Vellore, Tiruvannamalai and Erode, allegedly offering more than the Rs 36 per litre paid by Aavin to the producers. The State produces about 2.3 crore litre per day and the Aavin procures just about 36 lakh litres for its distribution, with a market share of 14%. The rest of the market is held by private players.

As part of the new strategy, Amul has begun to set up a network in Tamil Nadu to procure and sell milk within the state

The present expansion comes five years after a similar but futile attempt to enter the Tamil Nadu milk market and has provoked a strong condemnation from the state government. The state government’s protests however are ironic given that it has allowed several private suppliers in the state with the stated intention of increasing milk consumption among the people. Despite the price difference, private players have found a ready market. Dairy farmers are happy too as the private units clear payments every 15 days and offer generous concessions in feedstock and other inputs. Amul is set to enter the space between the private players and Aavin, which is likely to benefit the end consumer. Should the move succeed, on the one hand the private players would lose their market while on the other, Aavin would lose its procurement in a double dhamaka!

In his strong response to the dairy giant’s expansion, Chief Minister M K Stalin in a letter to Shah also recalled a non-aggression pact among state co-operatives not to procure milk in each others’ catchment. Abandoning such a pact is a deliberate act to destroy the state entity, says the government and echoed by the milk producing associations. Amul has responded by saying that it aims to procure in localities which lack with the presence of Aavin while denying that it is offering a higher procurement price.

Also Read: Aavin continues to be leading plastic polluter in TN: Survey

Karnataka conflict

Aavin is not the only state unit feeling Amul’s expansionary heat. In December 2022, ahead of the Karnataka Assembly elections, Shah had said that Amul and state milk federation Nandini should join hands to consolidate the state’s dairy market. The remarks sparked a furore and were seen as a move to erase the state’s identity.

And in the elections held in April, the BJP lost 37 seats to the Congress in regions where Nandini’s procurement network is entrenched. New Chief Minister Siddaramiah’s move to hike milk procurement prices is no doubt aimed at consolidating the electoral gains. Though the consumer may end up paying more, a hike in prices is unlikely to hurt Nandini’s advantage as the state unit sells milk at Rs 39 per litre while Amul retails at Rs. 54 per litre. While Nandini leads the milk market in Karnataka, AMUL comes in a distant fourth in consumer preferences despite is distribution network and branding.

Pan-India footprint

According to Amul’s annual report, the dairy giant plans to set up a network of 98 units across the country to meet the demand in the metros. It is also planning to increase the number of branches throughout India to 100, with the stated objective of providing milk and milk products at an affordable price to all. The Gujarat-based dairy major’s projections rest on a long history of cooperative dairy development, with its roots in the Independence struggle.

Aavin is not the only state unit feeling Amul’s expansionary heat. In December 2022, ahead of the Karnataka Assembly elections, Shah had said that Amul and state milk federation Nandini should join hands to consolidate the state’s dairy market. The remarks sparked a furore and were seen as a move to erase the state’s identity

Way back in 1946, the small Gujarat town of Kaira was on the boil with milk producers protesting against a cartel by brokers who denied them fair and remunerative prices. The aggrieved farmers turned to Congress leader Vallabhai Patel for help who suggested that they launch a co-operative society to procure and sell milk for a fair price. With further guidance from other Congress leaders like Morarji Desai, Tribhuvandass Patel and Harichand Megha Dalia, the milk producers formed a co-operative, calling themselves the Kaira District Co-operative Milk Producers Association, with its headquarters at Anand. They launched their venture with two milk producer societies, procuring 247 litres per day.

As more farmers joined the cooperative, it was later named the Anand Milk Union Limited, forming the ubiquitous acronym AMUL. The body was later renamed as Gujarat Co-operative Milk Marketing Federation Ltd which still controls the brand Amul. Varghese Kurien, who would lead India’s White Revolution, headed the union since 1950. When then Prime Minister Lal Bahadur Shastri visited the Anand plant in 1964, he wanted to replicate the experiment across India which led to the setting up of the National Dairy Development Board. The Board was headed by Dr Kurien again, and went on to propel India to several milestones in milk production and the setting up of several state milk producing cooperatives on the lines of Amul.

Also Read: A1, A2, fresh, sachet: Which milk is best?

Wake-up call

Cut to the present with the Gujarat dairy giant in expansionary mode. There are several issues at stake for the country as a whole and the state-based milk marketing federations, the primary concern being a destabilizing of a viable and efficient sector. There is no assurance that Amul will not increase the prices once it becomes a monopoly, albeit a Desi one, having outpriced the local entities.

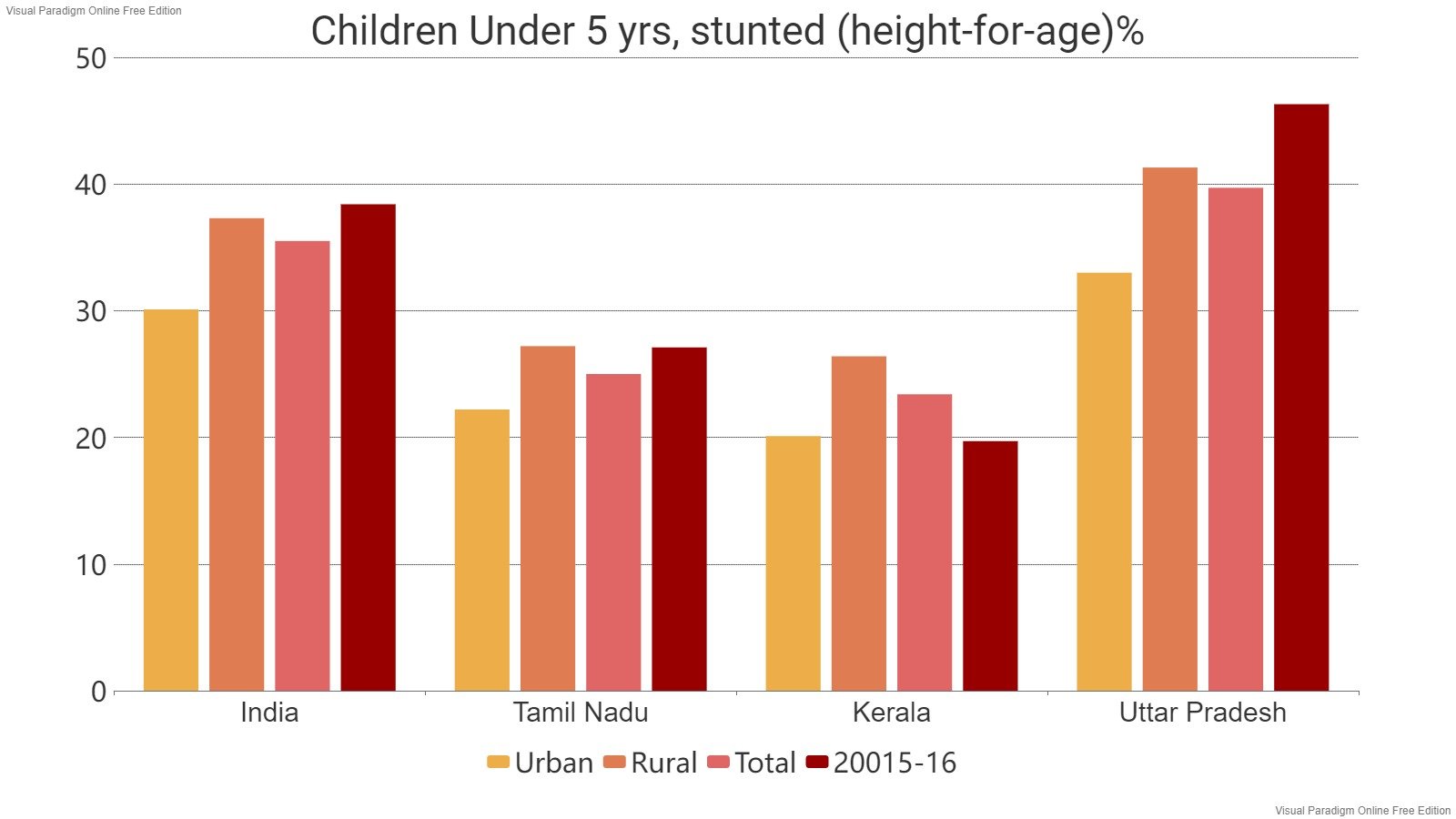

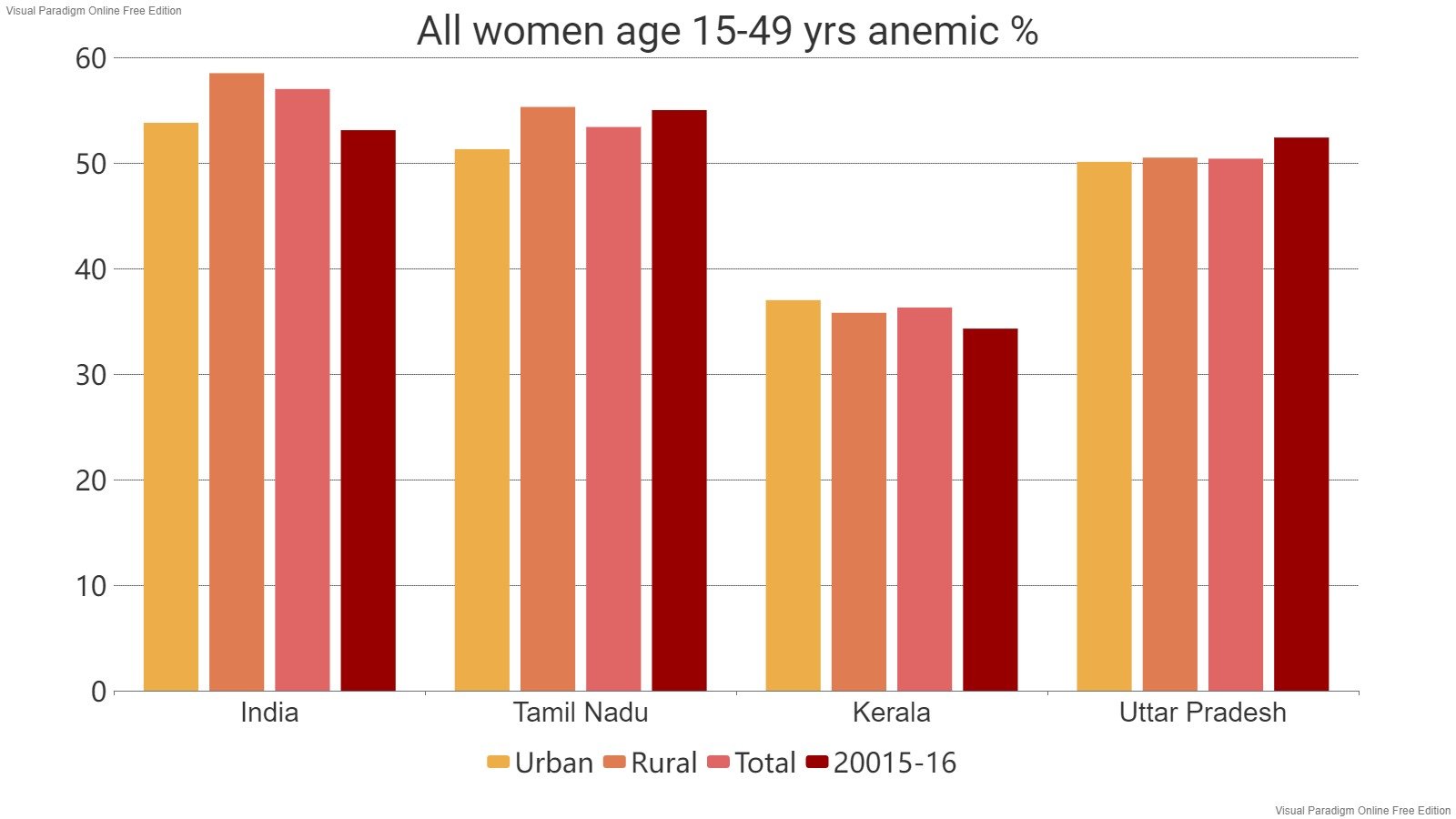

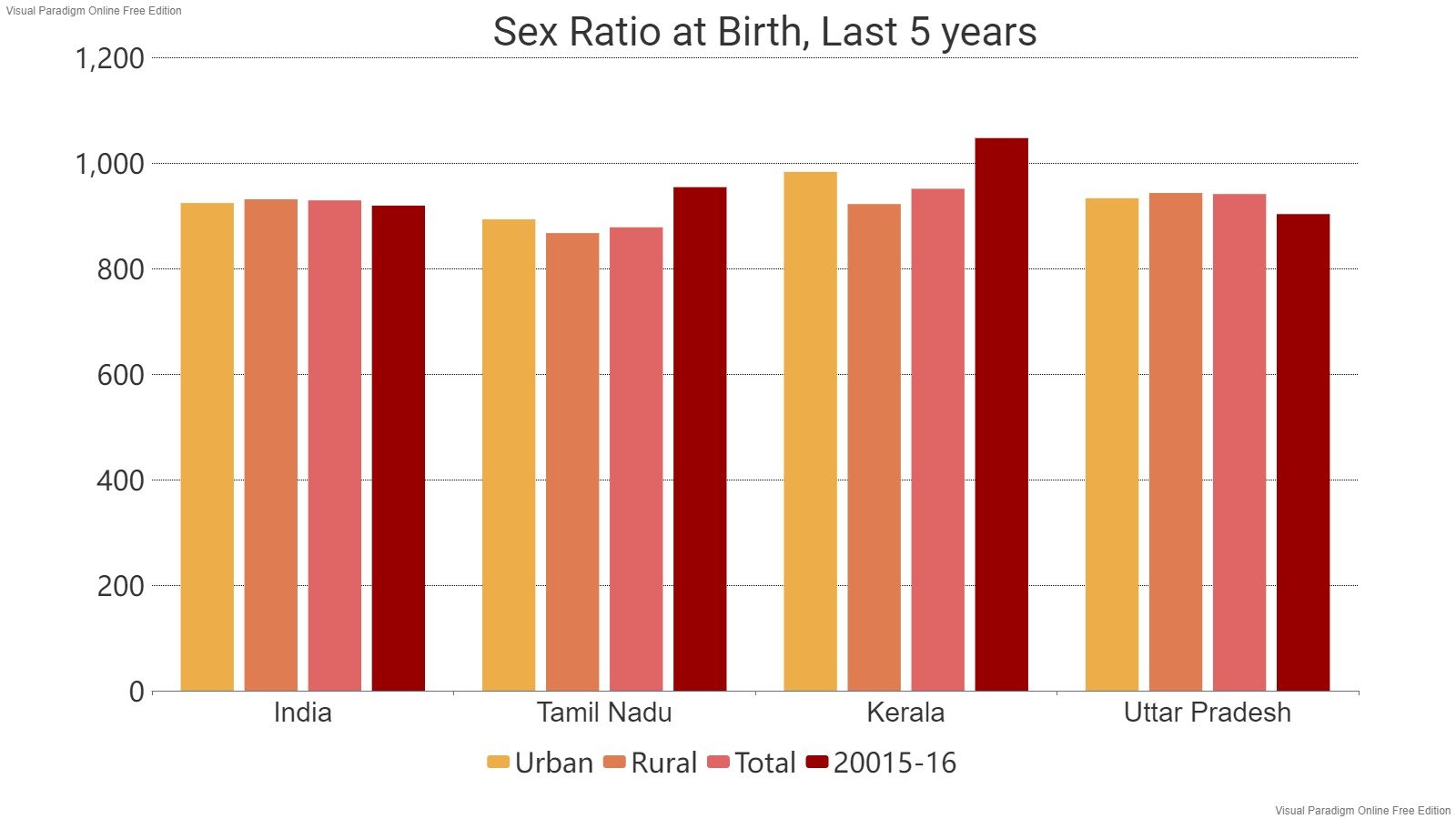

The controversy should also be a wake-up call for the state units mired in corruption and dependent on subsidies. A recent instance is that of Aavin’s printing of special milk sachets advertising the Chess Olympiad in Chennai in an ad hoc manner which allegedly incurred a loss of Rs 1 crore because the order was issued without a due tender process. Taking a leaf out of Amul’s successful strategies and management could help the state units turn profitable and aid the exchequer. Given the fragmented and uneven nature of the dairy sector with the threat of private monopolies, legislative intervention to strengthen the cooperative milk producing sector is vital to ensure nutrition security via the daily staple to all sections of society.

Read in : தமிழ்