Read in : தமிழ்

Commentaries on the Tamil Nadu budget 2022-23 presented by finance minister P Thiyagarajan (PTR) focused on how it served the Dravidian model. The ideological hegemony of neoliberal fiscal fundamentalism was evident in many of these commentaries. This is not surprising. However, what is disappointing is that, despite invoking in his budget speech the so called Dravidian Model, identified in the minds of many as being quite distinct from neoliberalism, PTR has essentially accepted the neoliberal diktat embodied in the Tamil Nadu Fiscal Responsibility Act (TNFRA). The minister is quite explicit in affirming his enthusiastic commitment to bringing down the fiscal deficit well below even the levels allowed by the 15th Finance Commission.

A look at budgetary allocations under various heads tells us a story of minimal pro-people development thrust. Most departmental allocations see marginal increases in nominal terms for 2022-23 as against budget estimates for 2021-22. Some even see nominal reduction. A very few see an increase in nominal allocation that will beat the inflation rate and provide an impetus for growth.

One such is the allocation for school education at Rs. 36,895.89 crore as against the BE in 2021-22 at Rs. 32,599.54 crore, an increase of 13.1%. The allocation for Rural Development and Panchayati Raj is another, with a rise in allocation from Rs 22,738 crores to Rs 26,647 crores, an increase of 17.2%. But most other departments see little or no increase. Thus Higher Education gets Rs 5,668.89 crore in 2022-23 budget as against Rs 5,369.09crores in 2021-22. The corresponding numbers for Health and Family Welfare are Rs 17,901.73 crore and Rs 18,933.20 crore, showing an absolute decline of more than a thousand crores. Social Welfare and Women’s Empowerment, Social Security and Adi Dravidar and Tribal welfare see a reduction in allocation in real terms. The budget is silent on the electoral promise of a return to the old pension scheme for government employees.

There is no serious effort to step up public expenditure in such crucial areas as infrastructure for equitable and sustainable modernization of agriculture, with a clear focus on raising farm productivity. There is no thrust on promoting value addition in rural agro-industry that could have made a contribution to decentralized development and addressed in-part the crisis of rural unemployment. There is no commitment to universalizing an urban employment guarantee scheme, ideally through appropriate legislation to ensure statutory backing. There is also no attempt to strengthen the MNREGS.

These outcomes are consistent with the view of the finance minister on the presumably “urgent” need for fiscal consolidation, meaning bringing down the debt as well as the fiscal deficit as share of the state’s gross domestic product. He had stated in his budget speech of August 2021: “With the fiscal consolidation as the fundamental principle…the State will continue to adhere to TNFRA norms and expects to bring down revenue deficit in the coming years, while continuing to invest in growth-oriented expenditure.”

In his budget speech, PTR claims that ‘From an economic perspective, social welfare and inclusive economic development are the two sides to be balanced.’ Why is ‘social welfare’ posed against ‘inclusive economic development’?

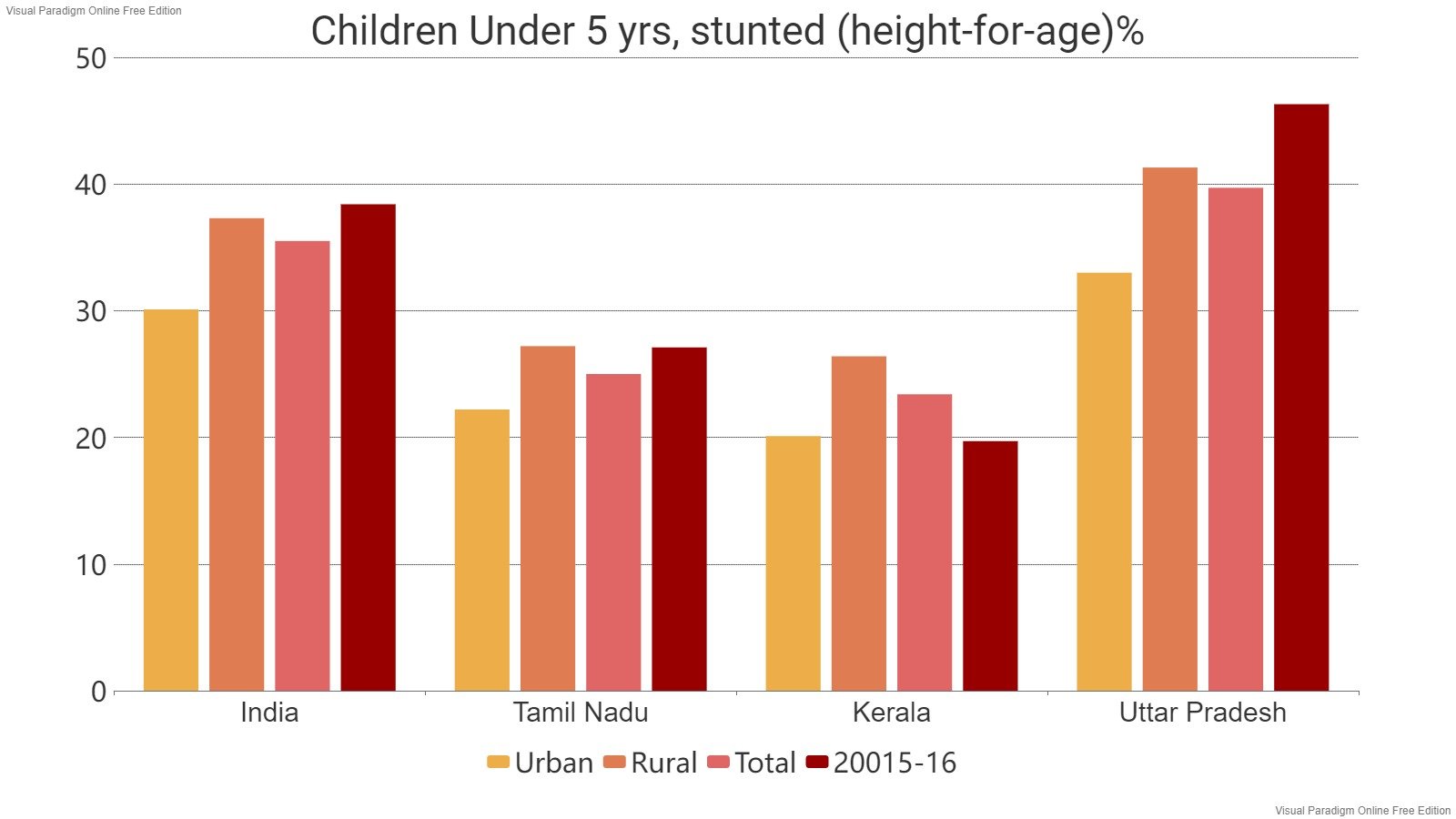

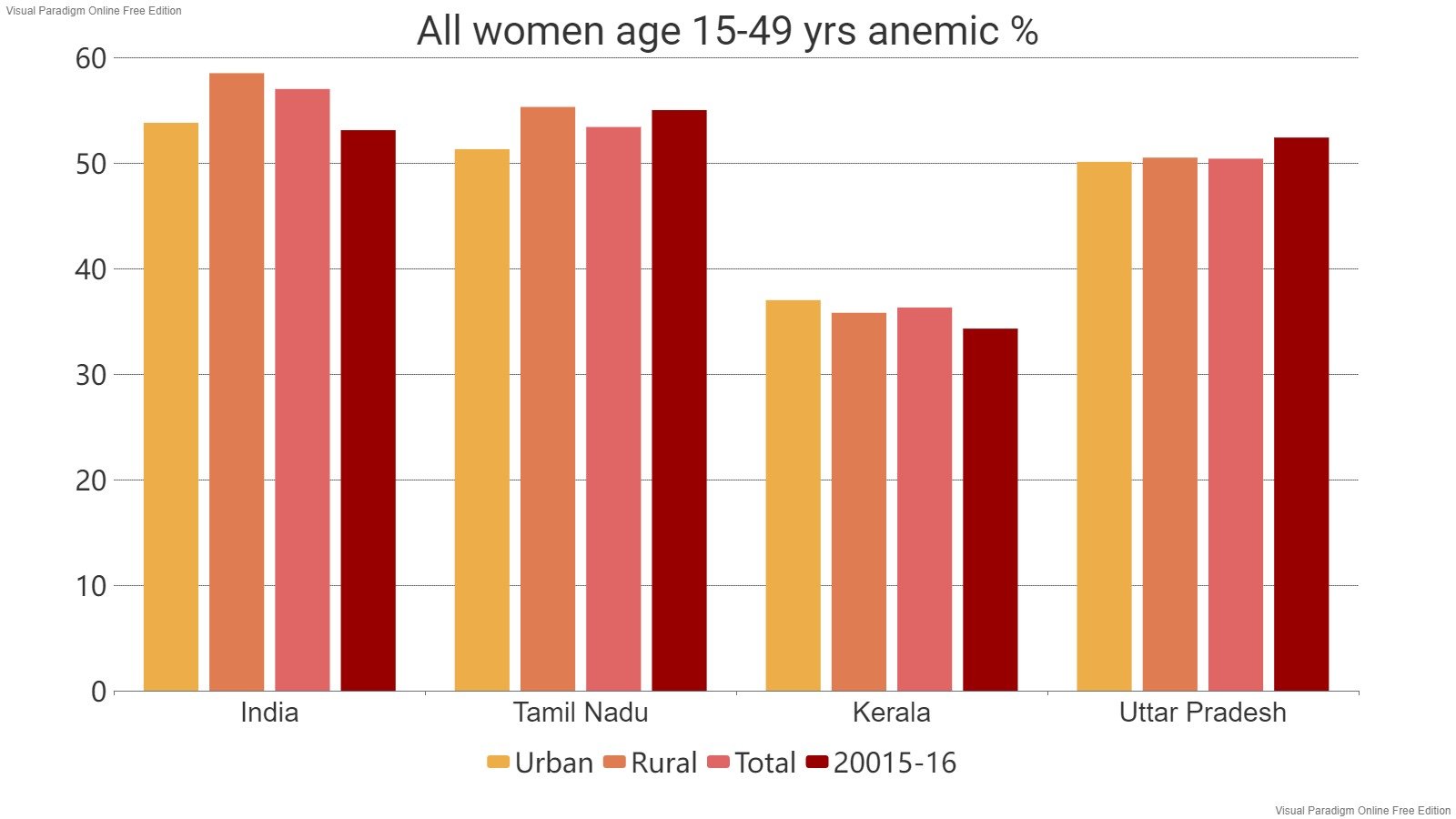

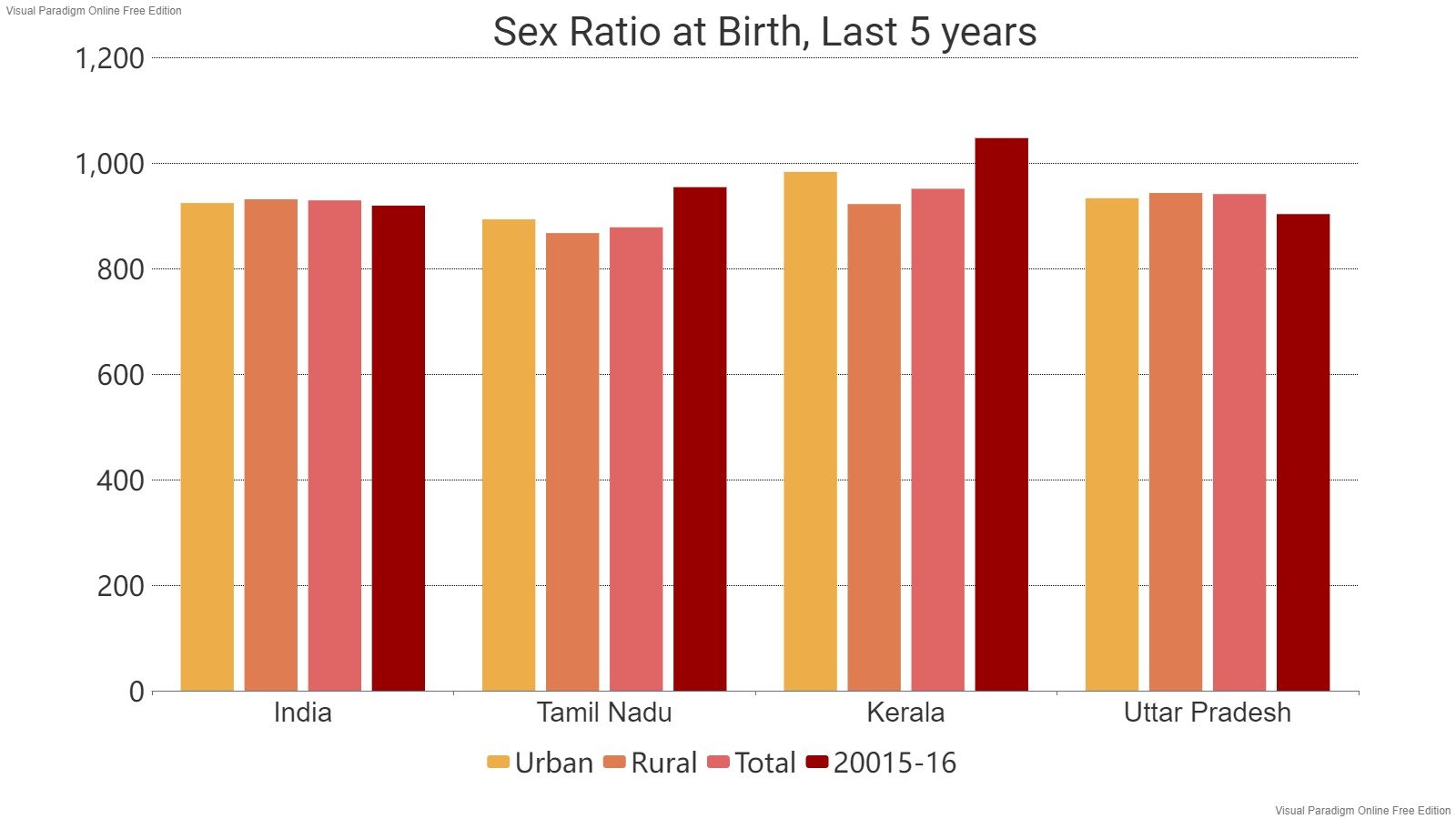

One problem in this discourse on the Dravidian model is the presumed conflict between measures that contribute to welfare and those presumed to contribute to ‘growth’. Why is it assumed that investments in human development including not just education, but also those in food and nutrition security, are unrelated to the promotion of growth?

In his budget speech, PTR claims that ‘From an economic perspective, social welfare and inclusive economic development are the two sides to be balanced.’ Why is ‘social welfare’ posed against ‘inclusive economic development’? This actually comes from seeing social welfare measures as acts of benevolence and charity on the part of rulers rather than as entitlements of people in a civilized society.

Neoliberalism is fundamentally incompatible with both ‘social welfare’ and ‘inclusive development’ that is upheld by the dravidian model. The conflict really is between ‘inclusive development including social welfare’ and neoliberal ideology that sees the democratically elected State as a nuisance and obstacle to an animal called ‘the efficient market’. Across the globe, neoliberal ‘growth, which primarily serves the interests of finance capital, has seen a sharp rise not just in inequality, but in mass deprivation, especially for working people. The point is not that one should reject growth as such, but that we should ensure that the growth is of the kind that empowers people and ensures the fulfilment of basic human rights — economic, social and political.

The specific context that we are in is one where people are struggling with the horrendous consequences of not only the pandemic and the lockdowns, but the serious slowdown in growth and sharp increase in unemployment and rural-urban distress for over five years following the demonetization disaster of 2016 and the GST fiasco of 2017 that destroyed the informal sector in particular. The periodic labour force survey 2017-18, the NSS Consumer Expenditure Survey of 2017-18 and the more recent NSS survey on the situation of agrarian households in rural India for the reference year 2018-19 all show widespread distress and lack of purchasing power among the mass of the people.

While Tamil Nadu may be relatively better off than many other states, the NSS survey of agrarian households in rural areas shows that the average monthly income of these households in Tamil Nadu is nothing to write home about and in fact suggests that a substantial proportion of the rural population will be poor by any reasonable definition of poverty.

When one notes that these are the outcomes after years of officially claimed GDP growth rates of 7-8% per annum, the inference that comes to my mind is that we need growth, for sure, but growth of a different kind, involving public investment in rural development as well as education, health care and urban and rural infrastructure, focusing on employment with a thrust on the micro, small and medium enterprises. This will not only require abandoning fiscal fundamentalism, but also more effective taxation of big business and the super-rich. Equally important, it will require a much greater devolution of financial resources from the Union to the States and a struggle to establish India as the Union of States that the Constitution mandates.

(The author is an economist and social activist)

Read in : தமிழ்